2020 has without a doubt been an exceptional year for the retail industry. An e-commerce boom accelerated by the pandemic, the digitalization of stores, a growing appetite for consuming better … trends that had begun to emerge in recent years have accelerated in the last 12 months.

Brands and retailers have had to be agile and adapt quickly to new shopping habits that are becoming more and more entrenched. As the year draws to a close, let’s take a look at the 12 things that shaped retail in France and elsewhere in 2020 and the trends for 2021.

2020: THE GROCERY E-COMMERCE BOOM

What happened in 2020

Grocery e-commerce in France gained 4 to 5 years of market share in 2020 according to Nielsen, driven by the 2.8 million new customers acquired during the first lockdown, of which 40% became long-term users of the service according to Kantar. This buying channel is thus becoming a permanent fixture in French consumers’ shopping habits.

This year, retailers and brands have stepped up their efforts to respond to this shift.

1. Monoprix opened its 100% automated warehouse that works on to Ocado technology: the result? An order of 50 items can be prepared error-free in 6 minutes. The retailer is now on a par with Amazon by offering its customers a 2-hour delivery time via their Monoprix Plus service.

But Monoprix is not the only retailer using artificial intelligence to increase productivity and improve its service:

- At the beginning of the year, Walmart opened its first fully automated click and collect

- Carrefour is experimenting with automated picking

Given the growing demand of e-commerce during the containment, many retailers have accelerated the optimization of manual order preparation by transforming their stores into “dark stores”.

2. Carrefour & Uber Eats, Franprix & Deliveroo, & E.Leclerc… partnerships with delivery platforms are increasing: spurred on by the crisis, grocery retailers have accelerated their partnerships with these platforms to optimize the last-mile delivery, often seen as the weakest link in the supply chain.

3. An average sales growth of +85% for the pedestrian pick-up in 2020: even if it is still in its infancy, pedestrian click and collect was the most dynamic channel of the year in France. It has attracted new city dwellers during the lockdowns because of its practicality and through offering prices comparable to those of hypermarkets.

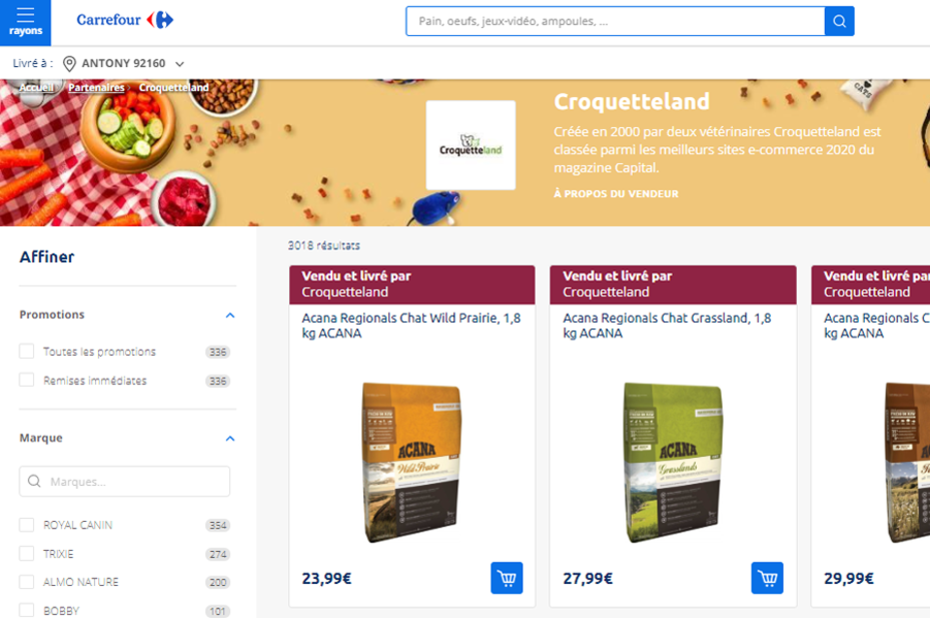

4. Carrefour launched a marketplace on its e-commerce website in June 2020: more than a hundred merchants were expected to be listed there by the end of the same year. This new business model allows Carrefour to expand its offer and monetize its website by tapping into its massive audience and regular customers.

5. Nestlé acquired the British start-up Mindful Chef, which delivers healthy meal baskets and frozen meals. The group is thereby investing in the forward-looking “direct-to-consumer” channel that is currently enjoying great success, particularly with the development of Digital Native Vertical Brands (DNVB). In the same vein, PepsiCo launched two DtoC e-commerce sites in the United States.

6. In partnership with Google, Carrefour started offering voice-activated shopping: voice commands, shared shopping lists, product preferences, etc. Even if other retailers such as Intermarché or E.Leclerc also offer a voice shopping experience, Carrefour and Google say they have taken the data integration and communication between their systems even further.

Trends for 2021

The success of online grocery shopping has gone well beyond the first lockdown and it’s safe to say that this channel will become even more ingrained in customer shopping habits in 2021.

To meet the high level of demand, retailers will have no choice but to rethink the entire supply chain:

- Creating automated platforms to optimize order preparation

- Restructuring to improve last mile delivery: will partnerships with delivery start-ups continue or will retailers develop their own solutions?

- Opening new pick-up points (at retailers, via boxes, etc.) to improve the receiving of orders…

One thing is for sure, to succeed in this challenge, retailers must invest now to stay in the game and increase productivity over the long term.

With the rise in traffic on their online stores and at their collection points, retailers should also rethink their models to take advantage of this massive and steady flow of customers by creating partnerships with other merchants, as Carrefour did this year.

Marketplaces on their e-commerce websites, collection boxes or parcel reception at drive points… these initiatives could continue in the coming year.

This brings the idea of “everything under the same roof”, whether in terms of supply or service, which would ultimately build loyalty among end customers looking for convenience.

As for brands, they should continue to take advantage of the rise of e-commerce and digital as a whole to create a real connection with consumers and boost their engagement: strong presence on social media, creation of DtoC sites… getting closer to modern consumers will undoubtedly be an increasingly important focus for brands next year.

Finally, as we have seen in 2020, consumers’ shopping habits are changing very quickly. With the increasing use of voice assistants (smartphones and speakers), will 2021 be the year when voice begins to enter consumers’ shopping habits? For this to happen, the experience offered by retailers will have to be second to none!

“CONVENIENCE” AND “DIGITAL”, THE WATCHWORDS FOR STORES IN 2020

What happened in 2020

While advantageous for e-commerce sales, the pandemic was not good for hypermarkets that had already been struggling in recent years. During the last week of November 2020, hypermarket sales in France were again down vs 2019: between -7% and -2% according to Nielsen. However, travel restrictions related to the crisis have benefited convenience stores in 2020: +28% sales during the first containment period.

Whether in big-box stores or in convenience stores, this year again, retailers have stepped up the digitalization of their physical points of sale to enable social distancing, provide a smoother experience and encourage customers back into stores.

7. Sainsbury’s saw the number of users of its Scan & Go app grow significantly: 37% of sales were made via the Scan & Go app between April and June 2020, whereas this channel represented only 15% of sales at the end of 2019.

Encouraged by the pandemic, other retailers have accelerated the deployment of their own self-scanning application such as Asda or Carrefour with its “Scan Lib by Phone” app.

8. Amazon One technology now allows you to pay with the palm of your hand: to simplify in-store shopping and checking out, Amazon has continued to innovate by further dematerializing payment. However, questions remain about the sharing of biometric data and the security of storage.

9. Monoprix is experimenting with “Black Box“, its first 100% self-service store: inspired by the principle of Amazon Go, Monoprix has launched its first store accessible 24/7 via cell phone. The company’s ambition is to deploy this concept in high-traffic areas (train stations, airports, etc.) where consumers are looking for snacks and convenience products.

In France, the start-up Storelift has also opened two connected and autonomous stores called “Boxy“. Much more than a box, Amazon opened its first unmanned, cashierless supermarket in Seattle last February.

10. Thanks to “Amazon Explore“, consumers can shop in-store virtually: what’s the idea? Interactive and customizable sessions with local tour guides, assistants or personal shoppers, making stores virtual.

The trends for 2021

How to bring customers back into stores in 2021? This is one of the main challenges that retailers will face in the coming months.

This year, many French people have tested the e-commerce path for the first time. These customers will now expect to have the same shopping experience in terms of convenience and time saving. In order to respond to this, the digitization of the shopping experience and the dematerialization of in-store payment seem essential and we should continue to see initiatives along these lines in the months to come.

Consumers are also increasingly impatient: they expect to be able to shop when they want, where they want. For this, self-service stores seem to be an appropriate solution to allow customers to shop for essentials anytime. Will we see this concept deployed in France in a larger format with a wider range of products, following the example of Amazon Fresh in the United States?

With the rise of convenience stores, retailers might also consider rethinking their store model. These points of sale could become a link between consumers and other merchants (dry cleaners, shoe repair shops, etc.). Some initiatives have already emerged over the past few years, such as La Poste at Monoprix, Hema at Franprix and Amazon boxes at certain retailers. We could see a pooling of services in local stores.

2020: A GROWING DESIRE TO “CONSUME BETTER”

What happened in 2020

For several years, consumers have been eager to “consume better”. Organic products, locally produced, with less packaging or Made in France: this trend has become even more pronounced during the health crisis. According to a Harris Interactive & budgetbox study, product quality is the 2nd most important criterion for shopping in 2020.

11. Carrefour acquired Potager City, a specialist in delivering local fruit and vegetable baskets: through this acquisition, Carrefour is expanding its e-commerce offering, positioning itself on new channels and meeting expectations for “consuming better “. In the same vein, Carrefour had acquired the start-up Quitoque in 2018 and also became involved with LOOP in 2019 to offer products with deposits on recyclable packaging.

12. The CO2-score will now appear on the packaging of food products: this logo will allow consumers to understand the impact of the product on the environment. This initiative should appeal to modern consumers who are increasingly concerned about their environmental impact and are looking for transparency on the products they buy.

Trends for 2021

Despite an economic crisis that puts price at the top of the list of purchasing criteria, consumers are increasingly well informed and the trend of consuming sustainable products is expected to grow in 2021 among all ages.

To stand out from the crowd, brands and retailers will have to step up their efforts and continue to implement eco-friendly initiatives for their products, their packaging and their delivery methods. We can therefore expect more and more of them to put product quality and sustainability at the heart of their strategy in 2021.

Competition in this market is already strong thanks to the arrival of new small brands and will undoubtedly increase in the coming months. The traditional large FMCG groups will have to be as agile as their new competitors.

In order to be successful, we can expect to see an increase in partnerships between major retailers and environmentally friendly brands over the coming months.

TO CONCLUDE

This year has seen an unprecedented shake-up of retail and shopping habits, and these changes seem to be lasting ones. Retailers have shown that they can adapt quickly and with agility.

So what’s the challenge for 2021? To sustain and build on the initiatives developed over the last 12 months, in order to:

- Retain new e-commerce consumers in the long term

- Get customers to come back to stores

- Meet consumers’ expectations for “better consumption” as much as possible

See you in December 2021 for the results!